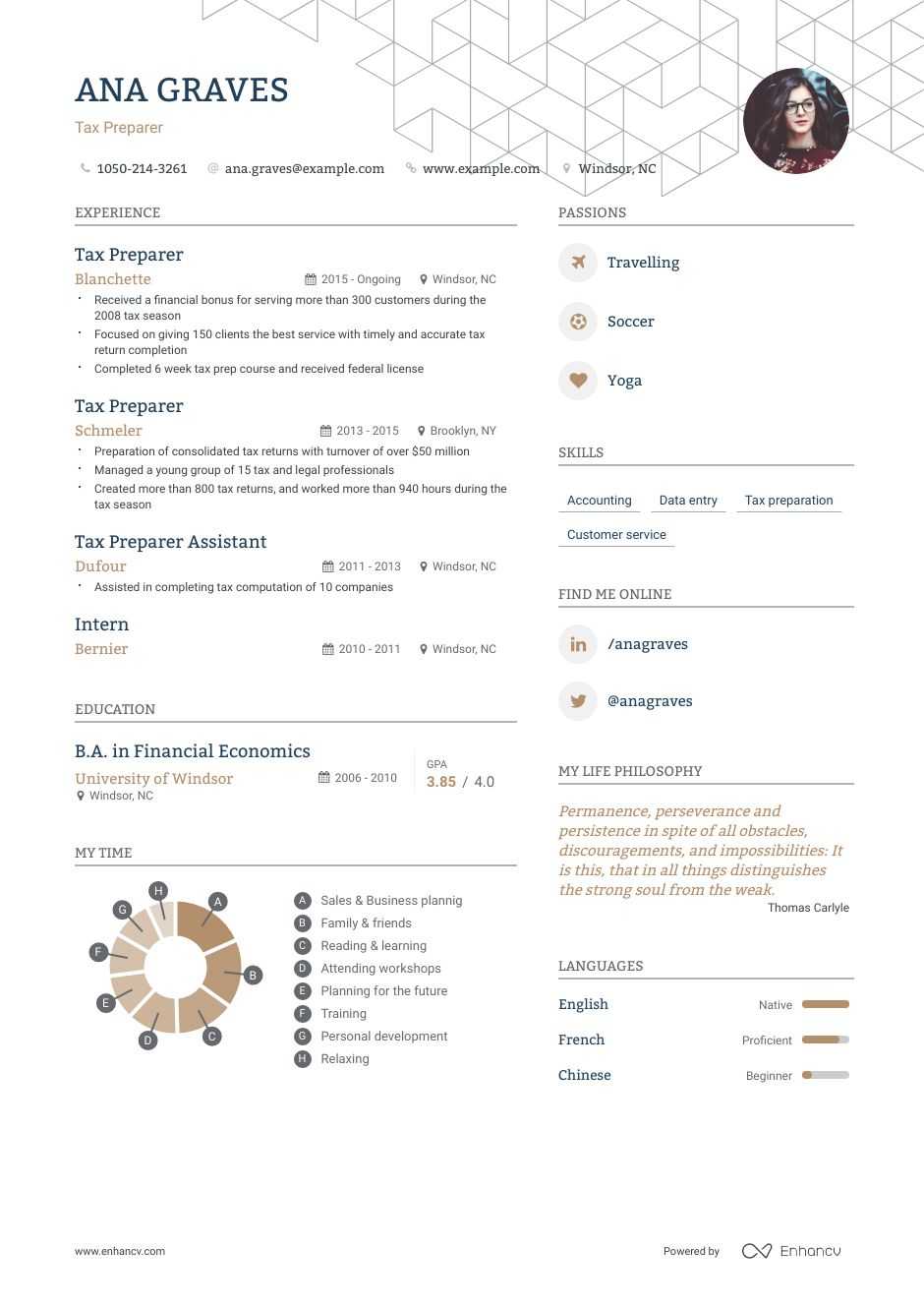

What should a tax preparer resume include? Often, i's not only about the data-driven approach you have, but also your interpersonal skills. How can you showcase your own experience and skills on your tax preparer resume? We have a step-by-step guide to help you create a tax preparer resume that highlights your professional and personal strengths. Here’s a list of what else we’ll cover in this tax preparer guide.

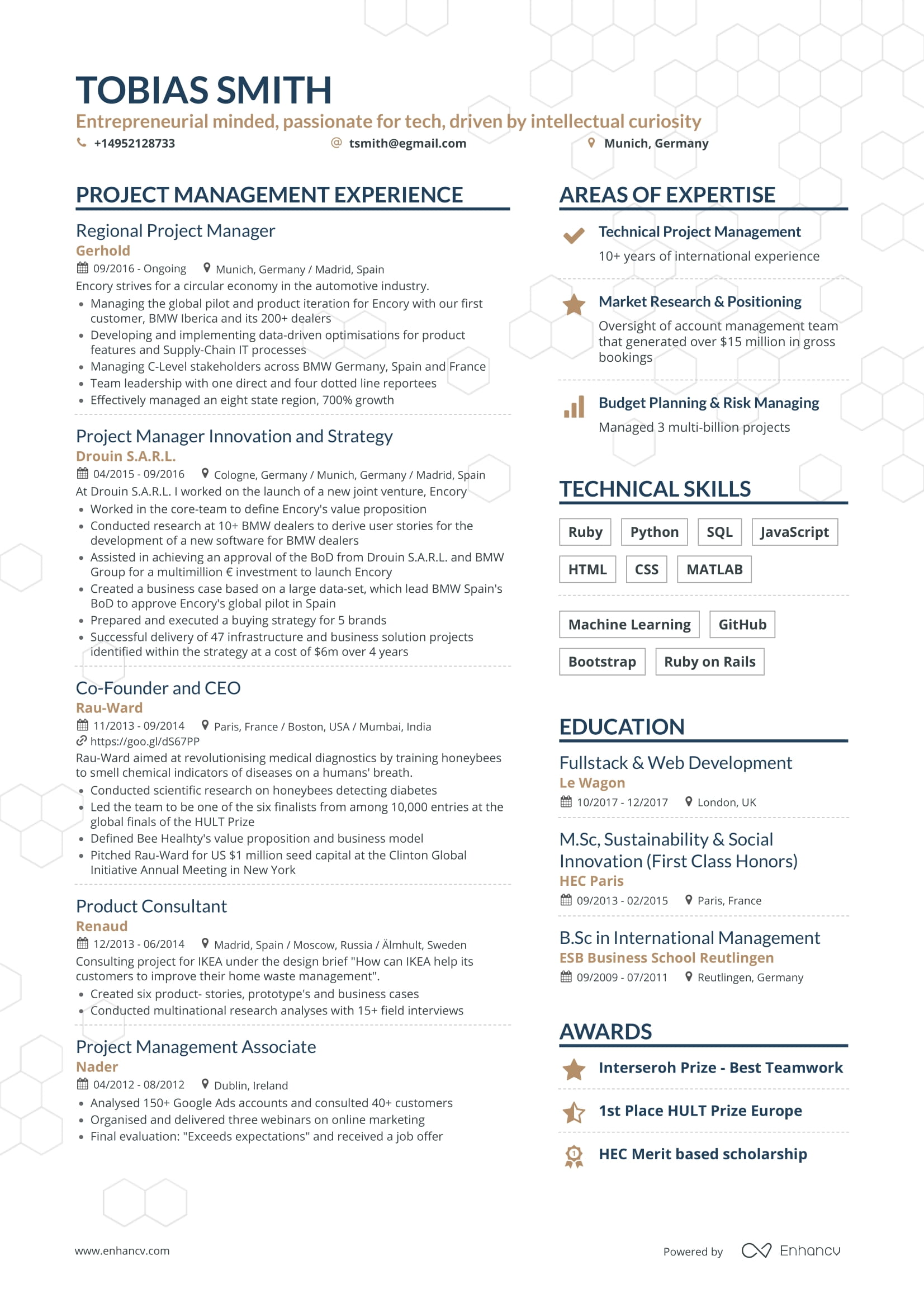

What are the best practices to write an experience section for a Tax Preparer resume?

What every Tax Preparer resume needs to include is a strong list of professionally presented experience. Let’s take a look at how to do that.

Be Specific!

Your experience section is often the one a potential employer looks at first. So keep in mind that the rule of a thumb is to show rather than tell. Make each bullet point of your tax preparer resume experience section count, mentioning the impact you had in your previous positions. Make sure every point is accompanied with a concrete example. So don’t just say you’re great at data analysis, demonstrate it.

Not just logical, but chronological too!

There are a couple of things to keep in mind when writing your experience section. As we already said, one of the key things is to be as specific as possible and quantify your results. The next step is start selecting which experience to include in your tax preparer resume and how to order it. It's best to keep it chronological. That means starting from the most recent position and continue further down. Also, carefully select what experience you write down and don't share everything you’ve ever done. The key here is to include only what a recruiter wants to see.

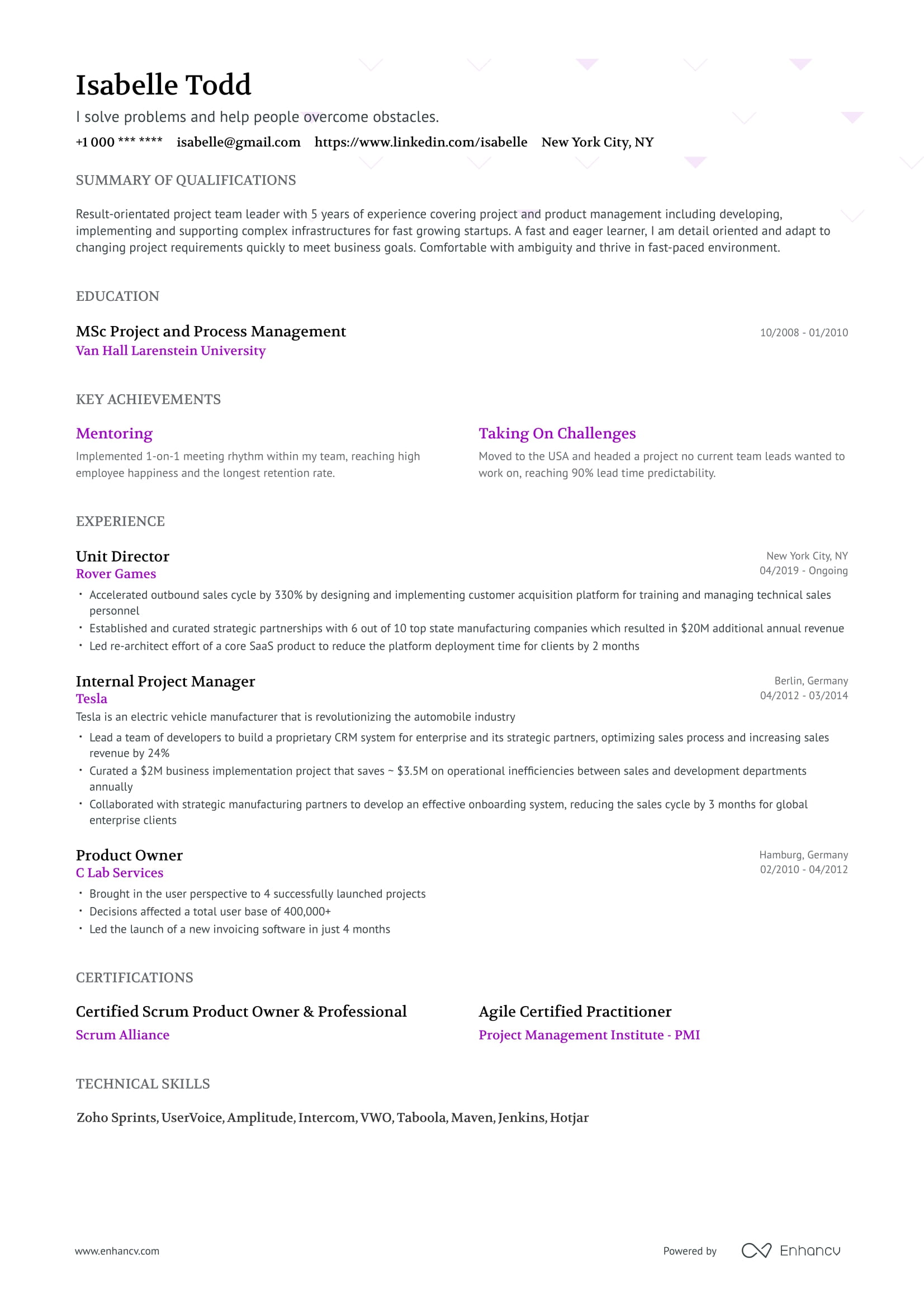

What's the average experience on resumes VS job description for a Tax Preparer?

As you can see, the experience required by employers for a tax preparer job and the experience found in Tax Preparer resumes is pretty balanced. Still, to stand out in your job search, follow our guide and advice on how to write the best Tax Preparer resume employers have ever seen.

Average Experience On Resumes vs Job Offers

2yrs2mo

avg. experience on resumes

vs.

2yrs6mo

avg. experience on job offers

Source: enhancv.com

Cause and Effect - Tell them how you made a difference!

Simply put, recruiters don't like overused buzzwords. They’ve read a thousand times about how someone managed, improved, or optimized something without any concrete numbers to back it up. The result? These resume skills that aren’t quantified largely get ignored or even count against you. The solution is to focus on concrete numbers which demonstrate your impact as a tax preparer. So instead of “conducted tax interviews” write “conducted 10+ tax interviews with clients per month”. Those kinds of resume action words really stand out and leave a strong impression.

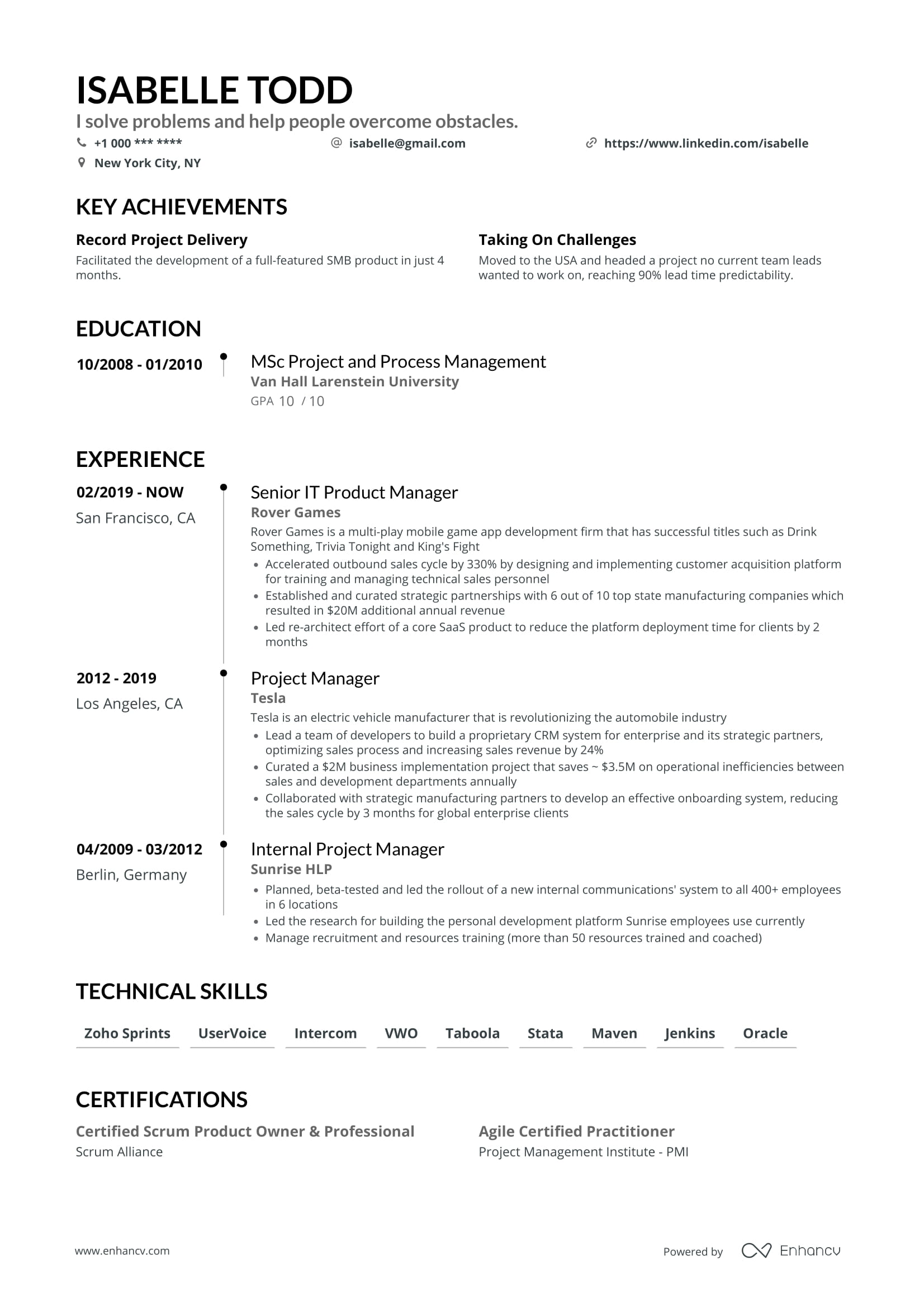

Unique content ideas for a Tax Preparer resume

When you send your resume to a potential employer, chances are it's the fiftieth one they've seen that day. That's why you need to make your tax preparer resume stand out for the right reasons. That means showing your personality, not just your professional experience. Employers are far more likely to remember a candidate who seems like a genuine person and not a robot. Do this by including your passions (which is also a great place to demonstrate skills on a resume), share your favorite books, or even what your usual day looks like.

Tell them what you’re proud of!

What are you most proud of? This section doesn't have to include things and situations from your professional life. You can include something interesting about yourself and show where your true strengths are. You can share a story about overcoming hardship, learning an important life lesson, or just a triumph you had that means a lot to you. Either way, this is one of the best places to make your bank teller resume really stand out.

This guide shows the basics of writing a modern and effective tax preparer resume. We hope you found our techniques useful and will use them wisely when creating your Tax Preparer resume. Let us know when you get the job you love!