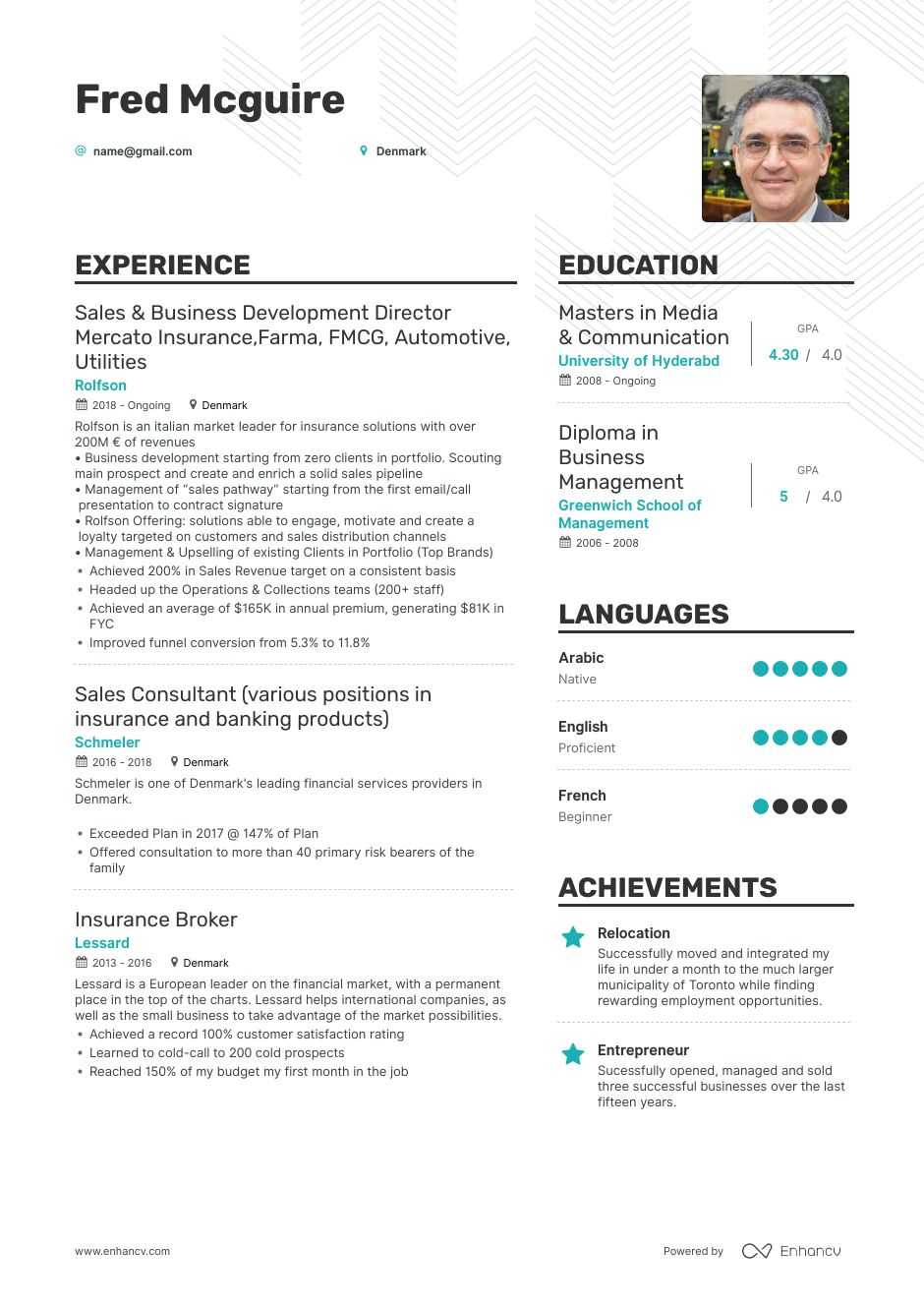

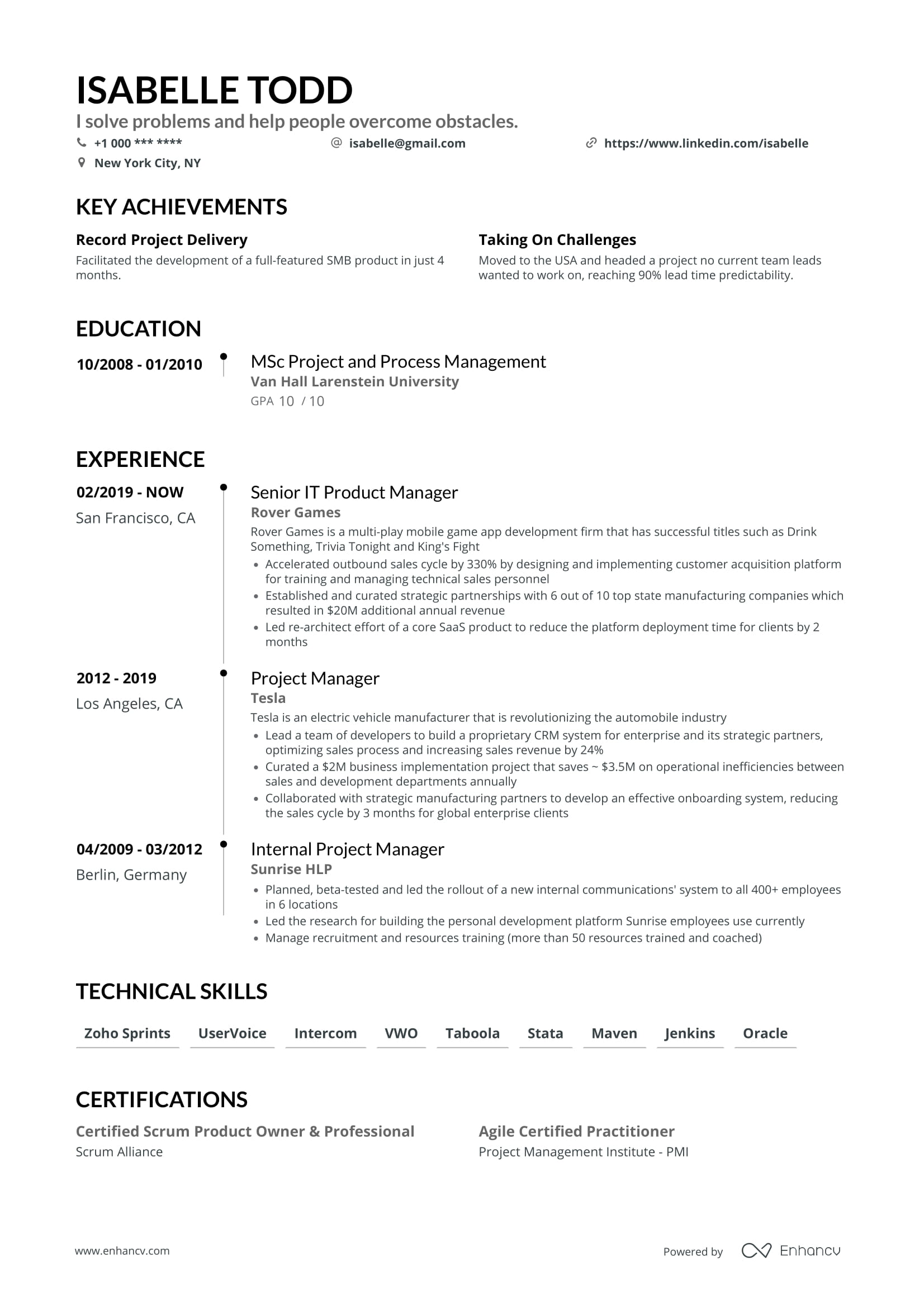

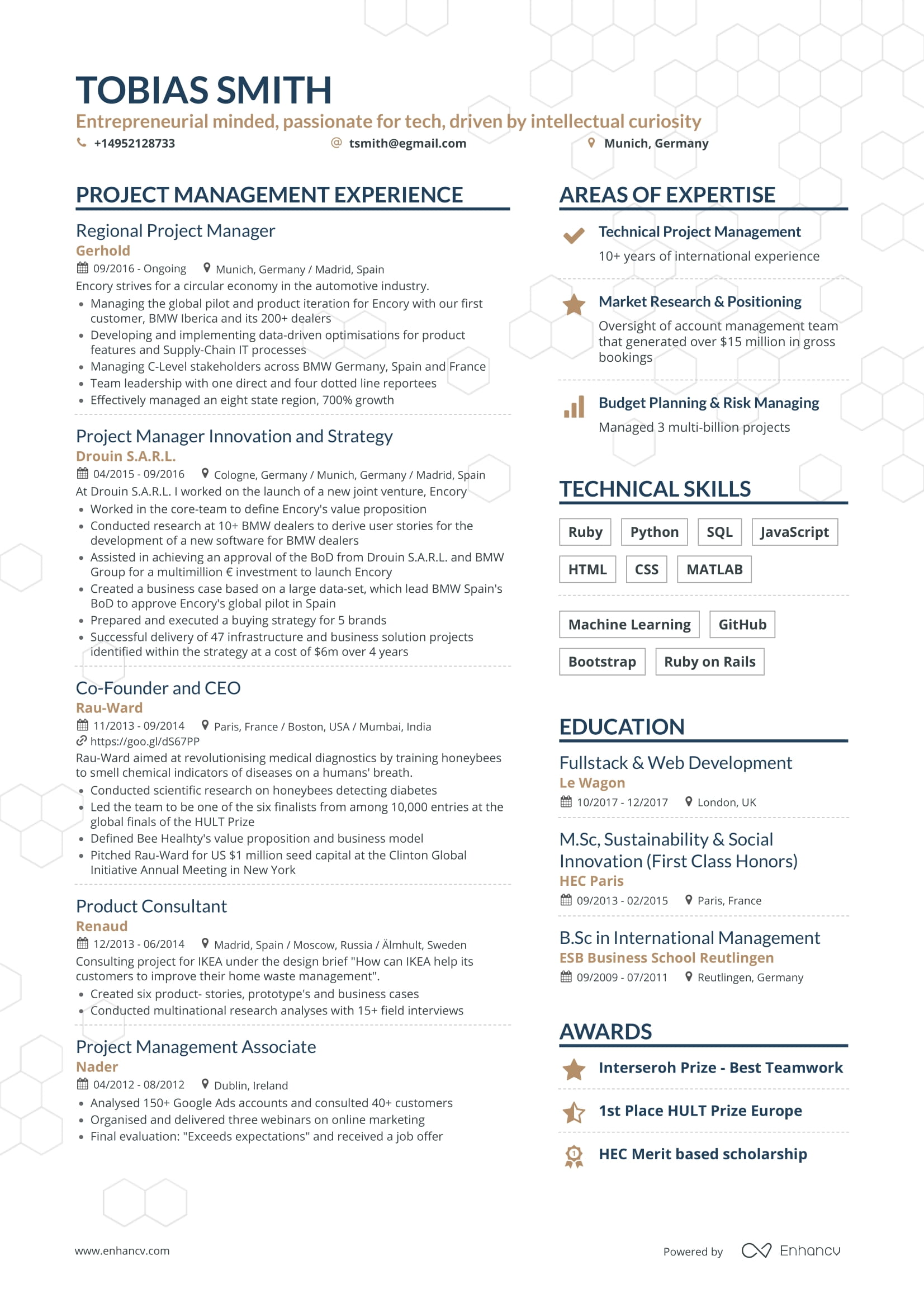

Example Insurance Sales Resume - Browse more resume templates and build a stand-out resume

Say hi to Julie.

She’s recruiting for the Insurance Sales position that opened up at the big insurance company in town.

Working for this company would be a dream.

The commissions are huge. The job security is high.

It’s the fast-paced job you’re made for.

Not to mention, you would get to flex your natural talent for selling.

But how do you impress Julie enough to land a coveted interview spot?

With an outstanding resume.

This guide will teach you how to write a resume that will land you the job you want.

Let’s get started.

This Insurance Sales Resume Guide Will Teach You:

- 6+ samples of stand-out insurance sales resumes

- How to list your insurance license information

- How to sell yourself in your resume summary

- 24 meaningful skills that will impress the recruiter

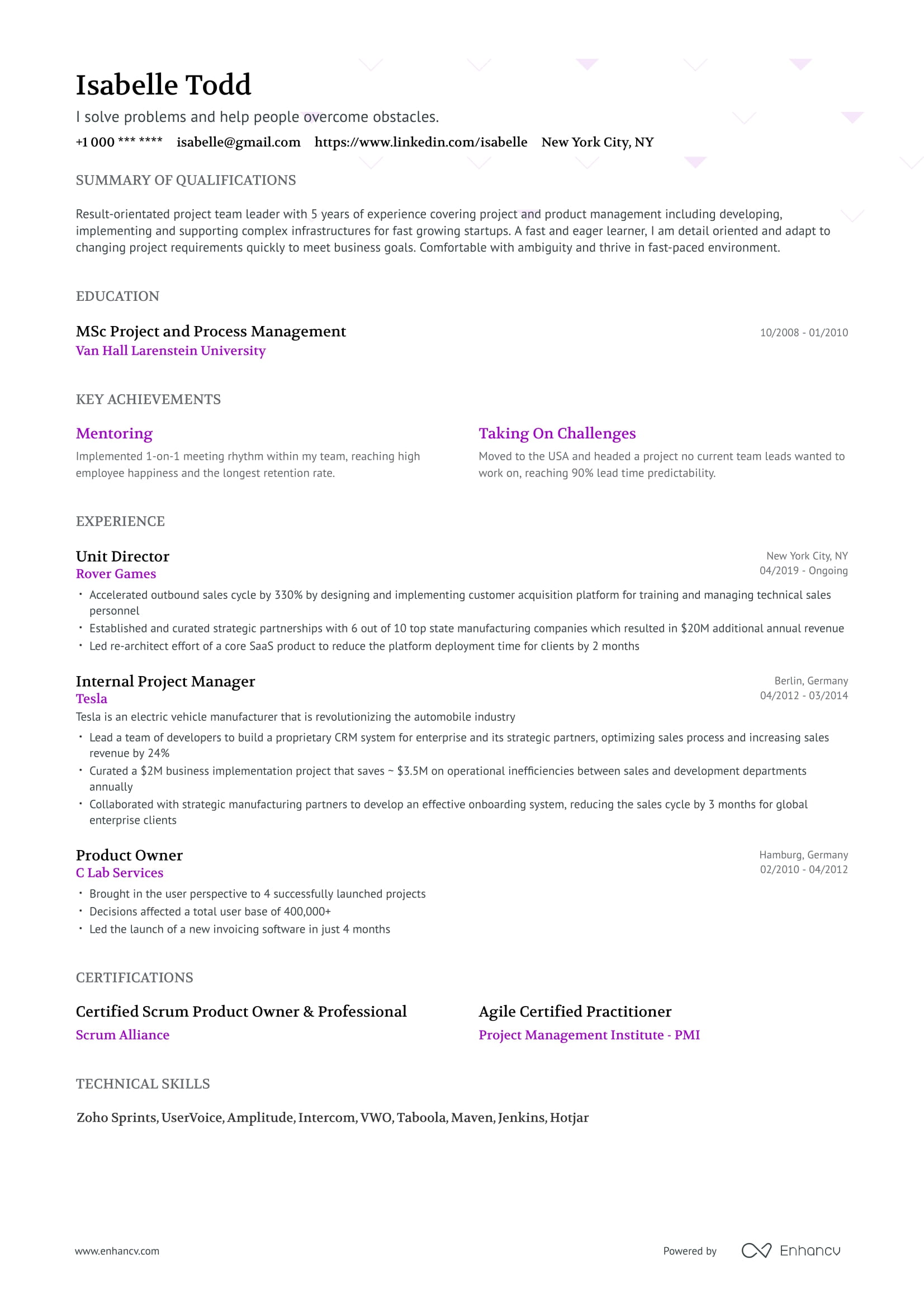

Insurance Sales Resume Samples

Looking for related resumes?

- Account Manager Resume

- Sales Manager Resume

- Entry Level Sales Resume

- Sales Associate Resume

- Sales Director Resume

How to Write a Job-Winning Insurance Sales Resume

Your resume is where first impressions are born.

Hiring managers spend an average of 6 seconds scanning your resume.

6 seconds.

What you make of those 6 seconds will be the difference between whether or not they’re interested enough to keep reading.

As an insurance sales agent, you know very well that first impressions are everything. If you can’t hook a prospective customer in right away, you’ve lost the sale.

Resumes are the exact same.

You need to hook in the hiring manager with your incredible insurance sales resume.

That’s how you land an interview.

A successful insurance sales resume will demonstrate:

- A proven track record in sales

- Approachable attitude and excellent soft skills

- Passion for the industry, and the role in particular

Highlight your sales track record in your summary and work experience section.

Show off your personality and skill-set throughout your resume too.

And most importantly, personalize every section for the job you want.

The Most Important Sections of an Insurance Sales Resume:

- Clear, organized layout

- Resume summary that sells who you are

- Work experience that proves you’re competent

- Well-rounded mix of skills

How to Write an Informative Insurance Sales Resume Header

Your resume header is where recruiters will glance first.

Make this section strong and you’ll be off on the right path.

Let’s say you’re applying for an insurance sales role at your local auto insurance broker.

Your header originally looks like this:

This header may look just fine, but it’s very basic.

It doesn’t give the hiring manager an opportunity to discover more about you.

Let’s show you a new one that reaches its full potential.

This is more like it! It has all of the header upgrades the recruiter wants to see:

- Shows your insurance speciality

- Links to your LinkedIn profile to discover more about you

- Includes more options to contact you - email and phone

How to Choose the Right Format for Your Insurance Sales Resume

Making your resume easily scannable will be the best gift you can give to a hiring manager, getting you on their good side.

Choosing the right resume format can be the difference between landing an interview… or not.

Thereverse chronological resume format is best suited for insurance sales resumes. They highlight your work experience the most, which is the biggest factor hiring managers will think about.

To make your resume even easier to read, cover these three bases:

- Use bullet points to organize information

- Split your resume into clear sections with headings

- Use an appropriate font

What if this 2000-word guide you’re reading was one huge paragraph with no spaces to separate?

You would probably feel super frustrated trying to read it.

The recruiter reading your resume will feel the same way too if you don’t use short paragraphs.

- 1-2 sentence paragraphs is the golden rule.

- Use a common font, like Arial, and make the text large enough to be mobile-friendly (11pt or higher).

- Save your resume as a PDF. It’s the safest file type.

How to Stand Out with Your Insurance Sales Resume Summary

Your resume summary is just like a sales pitch.

Just like you would sell home insurance to a customer by building their trust and making them believe in the comfort of their secure home.

You use those same skills to write an outstanding insurance sales resume summary.

Your summary will also build trust with the recruiter by highlighting your past accomplishments.

It will also make them believe in your commitment and passion for the role through personalizing your summary.

Let’s take a look at two examples.

2 Insurance Sales Resume Examples - Summary

Here’s a sample of the average insurance sales resume summary:

This summary misses the mark on those two things we just covered:

- It doesn’t highlight any sales accomplishments

- It isn’t personalized to the role you’re applying for

If this summary was a comprehensive home insurance policy, you would not be landing the sale.

Let’s take a look at the new and improved version.

Woah!

This summary has it all. It begins by mentioning your specialty in insurance (home) and then goes on to talk about how many years of experience you have (5).

The middle really shines when talking about real-life impressive sales stats, and then mentioning specific keywords like “prospecting” and “following up”.

The summary is topped off with a conclusion that shows your genuine interest in the specific job role. A personalized resume will always stand out from a generic one.

What Quantitative Data Should You Include on an Insurance Sales Resume?

The best way to build trust in your resume is by adding real stats from your career achievements.

It shows the hiring manager that you can replicate those results for their own company.

Stuck for ideas on what stats to add in?

Begin by asking yourself these questions:

- How many new accounts did you sign?

- How much revenue did you pull in?

- Did you increase referral business? By how much?

- What was your customer satisfaction rating?

- Did you exceed your sales quotas? By how much?

- How did you rank in your organization? Were you a top performer?

- Did you decrease the sales cycle? By how much?

You can squeeze in quantitative data throughout your summary and work experience sections.

Speaking of, let’s talk about your work experience section now.

How Should You Frame Your Insurance Sales Resume Experience?

The work experience section of your insurance sales resume is the most important.

When hiring for an open position, your future boss cares the most about one thing:

Return on investment.

They want to be confident that you’ll make more money in sales than the money they’re paying to employ you.

The only way to give them this confidence is by highlighting your former achievements.

Here are the questions the recruiter will be asking themselves while scanning your work experience section:

- Have you won sales awards?

- How many new accounts did you sign?

- Did you exceed your sales quotas on a regular basis?

- Do you have a strong relationship with your clients?

- Have you generated significant revenue from insurance policies?

Let’s take a look at two experience samples from insurance sales resumes.

2 Insurance Sales Resume Experience Samples

This work experience blurb isn’t strong enough yet. It only lists the responsibilities in the role, and not the impact made.

Let’s try it again.

Now that is an experience section that inspires confidence that you’ll do a great job.

Does Your Insurance Sales Resume Need an Education Section?

While experience and skills will be the star of your resume, you still need to include an education section.

You don’t need a Bachelor’s degree to land a job in insurance sales, but it can be helpful. List your school name, what degree/diploma you received and what years you attended. If you attended college or finished off at high school, include those names too!

This is also the time for you to list your insurance license information. Every state, province and country has different rules about licensing, but most do require it. List the name of your license, where you received it and when.

24 Skills to Add to Your Insurance Sales Resume

Your skills are the driving force of your success in insurance sales.

If the recruiter isn’t convinced that you have the soft skills and personality to excel, then they won’t proceed with your application.

You must be an excellent communicator, have good people skills, and be self-motivated.

Having computer skills, like using Microsoft Office, or managing a CRM software is beneficial as well.

Highlighting both your soft skills and technical skills will show the hiring manager that you’re a well-rounded candidate.

24 Skills to Include on an Insurance Sales Resume

- Home insurance

- Auto insurance

- Life insurance

- Health insurance

- Business insurance

- Travel insurance

- CRMs (Hubspot, Salesforce)

- Closing sales

- Cold-calling

- Attention to detail

- Decision making

- Client management

- Networking

- Relationship building

- Quick learner

- Upselling

- Leadership

- Presentation skills

- Collaboration

- Microsoft Office

- Prospecting

- Compliance

- Customer service

- Teamwork

Key Points to Remember for an Insurance Sales Resume

- Use your past sales figures to highlight your career achievements

- Be cautious about not breaking any confidentiality agreements when revealing revenue figures

- Personalize your insurance sales resume for the job in as many instances as you can

- List your insurance license information clearly in your Education section