Example Banking Resume - Browse more resume templates and build a stand-out resume

Being a banker is one of the most sought after jobs in the world.

It’s prestigious and well paid, even at the entry level. You get to work with notable clients, helping them make enormous amounts of money.

That being said, competition is fierce. Becoming a banker, especially an investment banker, is notoriously difficult.

It all starts with writing a resume that stands-out from the crowd.

No stress – keep reading because this guide will help you write a resume that could land you a dream job.

Let’s get started.

What you’ll learn here

- How to write a resume header that has all the right information

- Our best advice for showing off your banking experience

- The most essential technical and soft skills needed to get hired

- How to format and display information on your banking resume

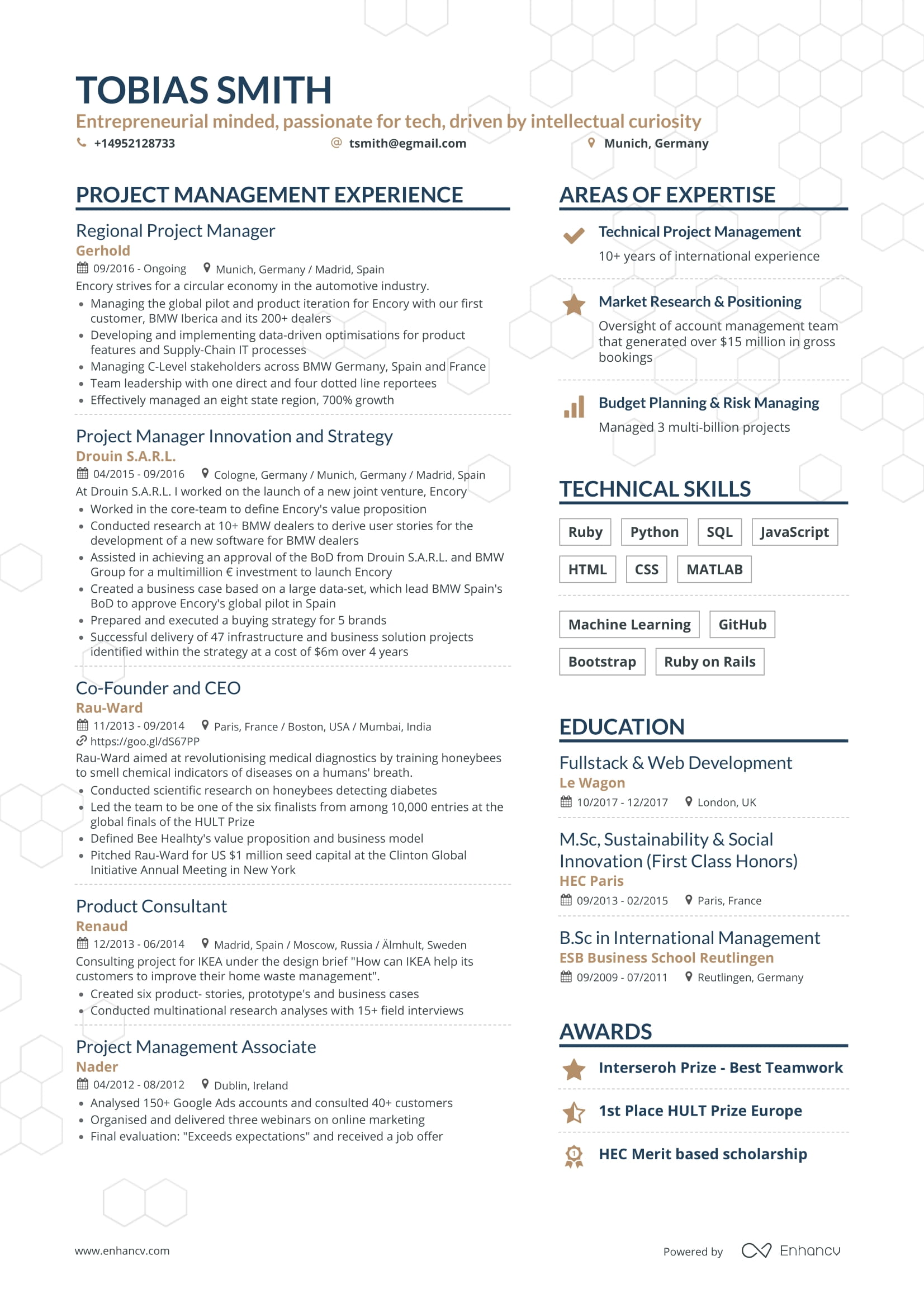

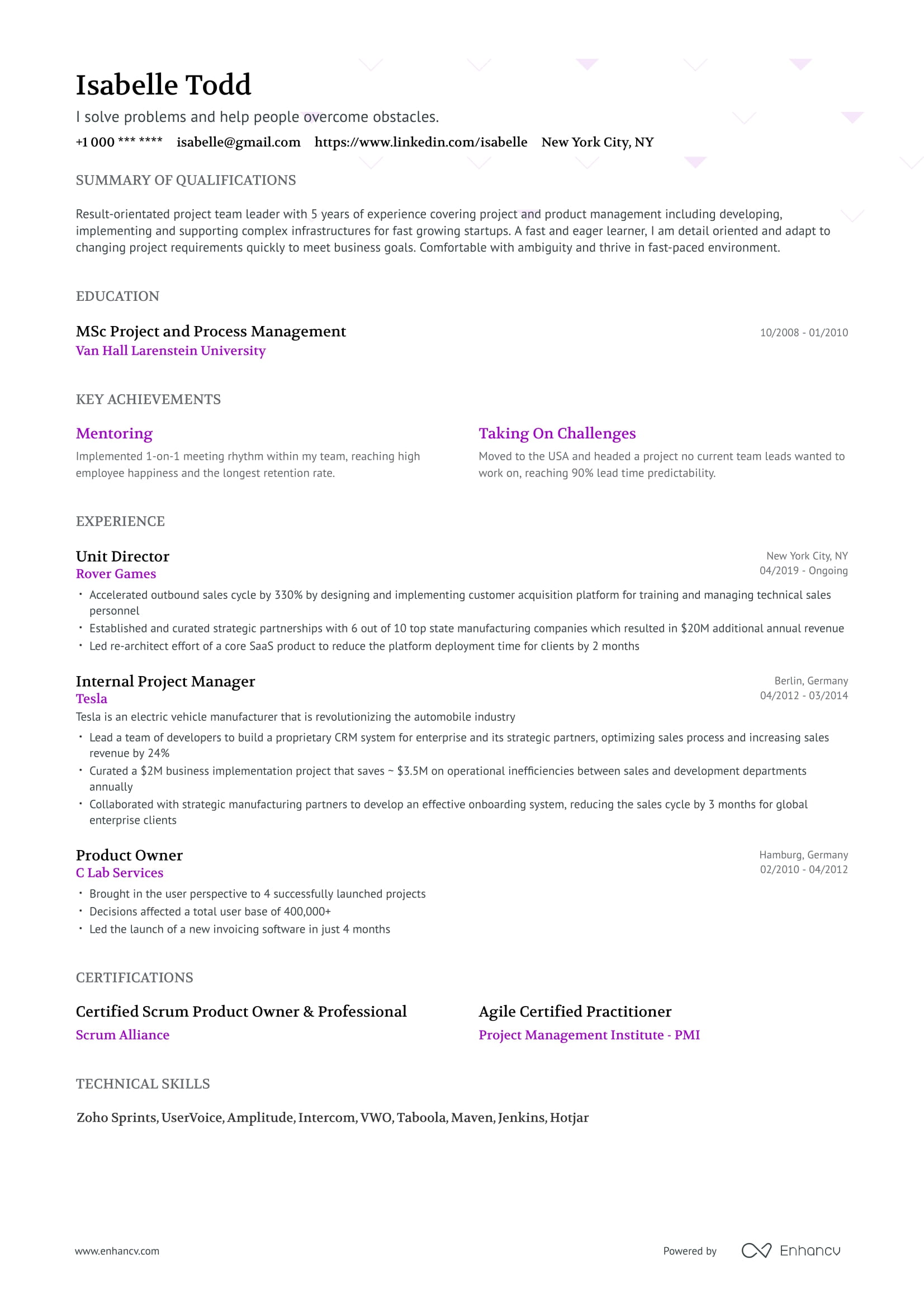

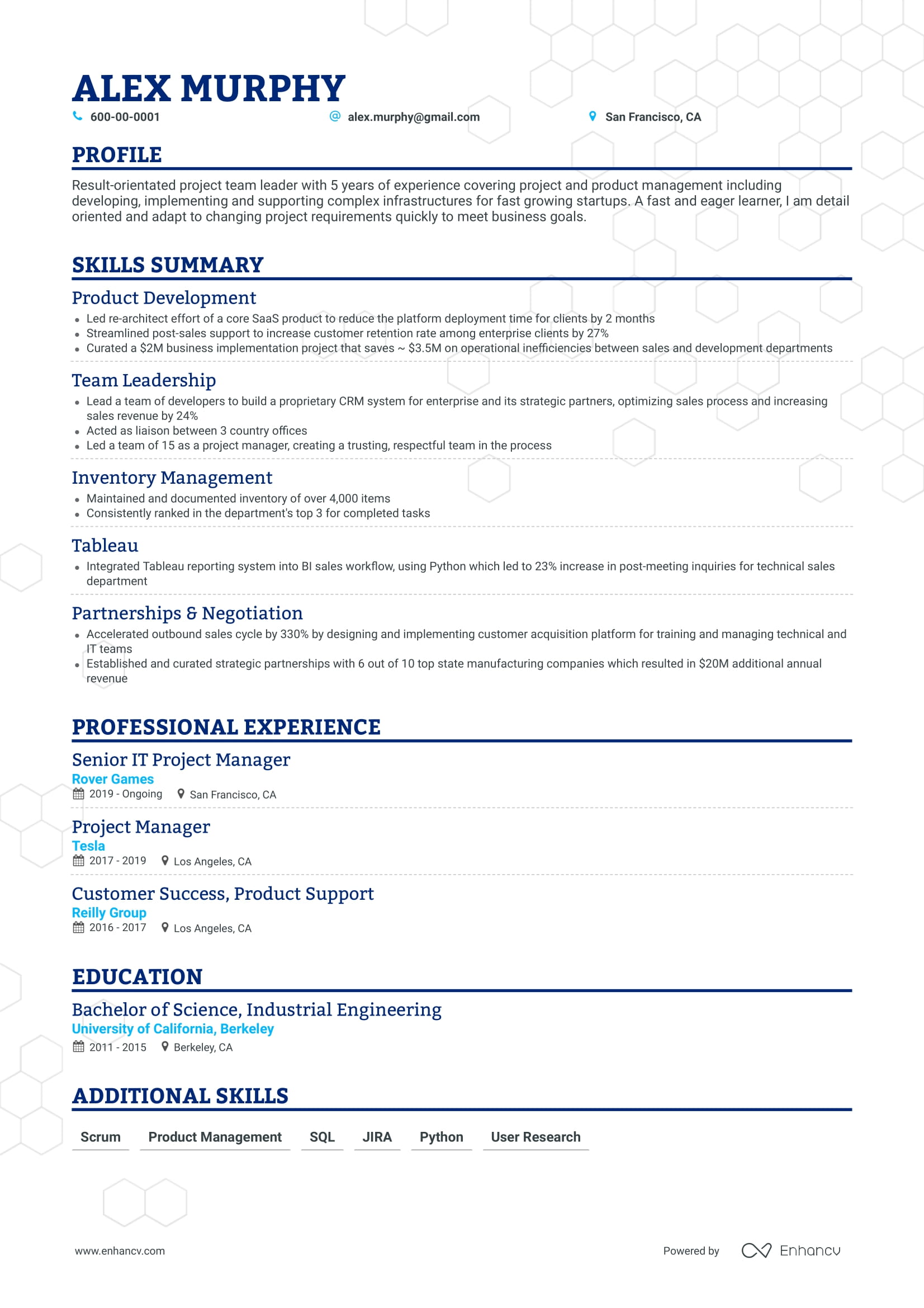

Banking resume example

Looking for related resumes?

- Bank Teller resume

- Banker resume

- Investment Banking resume

- Loan Officer resume

- Personal Banker resume

- Loan Processor resume

- Investment Banking Analyst resume

How to write a banker resume

If you’re an entry level banker fresh out of college, your resume should be formatted differently as a banker with 10+ years of experience.

An entry-level banker should lean towards afunctional resume format. This style brings attention to your skills and educational background (rather than your lack of experience).

When you’re just starting out, you will either have minimal or no banking experience at all. Instead of making that glaringly obvious to the recruiter, a functional resume format will draw their eye to your education and skills when they first scan your resume.

On the other hand, if you’re an experienced banker looking for a new position, use thereverse-chronological resume format. This emphasizes your work experience, and puts less of the focus on your education. As you progress in your career, your education becomes less and less important – experience takes precedence.

Once you have yourresume format selected, keep these othertips in mind to make your resume clear and concise:

- Use bullet points in your experience, skills, education and certifications sections to make your resume easily scannable.

- Don’t include aphoto on your resume if you’re applying in the U.S. – it’s illegal. Check the guidelines for your own country.

- Use a clear and legible font.

- Export your resume as a PDF so the formatting stays intact.

The essential sections in a banker resume

- Resume header

- Resume summary that describes your expertise

- A detailedexperience section

- An education & certifications section

- Skills section, with a mix of technical and soft skills

What recruiters want to see in a banker resume

- Experience in banking, private equity or finance

- Knowledge of financial modeling and valuation

- Excellent communication and relationship management skills

- An undergraduate or graduate degree in economics, finance, mathematics, or another related field

How To Write a Complete Resume Header

Aresume header is the very first thing recruiters see when looking at your resume, so it’s important to make a good first impression.

It’s where you’ll list out all of your contact details, your title, and your LinkedIn profile.

Here are a few things to keep in mind when writing your header:

- Include multiple options forcontact information like your phone number and email.

- State your seniority level (intern, junior, senior, etc.)

- Add in yourLinkedIn profile to give the recruiter an opportunity to validate your information.

Present yourself professionally and you’re off to a great start.

Here are two examples of resume headers – one done wrong, and one done well.

2 Investment Banker Resume Header Examples

This header gives off an unprofessional impression.

Why?

- No links to external sites like a LinkedIn profile

- Only one contact method included

- Non-specific title

Now, let’s take a look at a better resume header.

This header is much better:

- Specified title including the university name and subject area (assuming this is an entry-level position)

- Two options for contact: email and phone number

- LinkedIn profile included

Once you’re done writing your resume header, it’s time to move onto the resume summary where you’ll start to paint a picture of your expertise.

How To Display Your Financial Expertise In Your Summary

A banking resume summary should instantly present yourself as the ideal candidate for the role, even when a recruiter is doing a quick first scan.

Here’s how to achieve that:

- If you’re a recent graduate, include your university name, area of study and GPA.

- More experienced? Directly state how many years of experience you have, your key areas of expertise, and any notable companies you worked at.

- Highlight any specific quantifiable achievements, using real numbers and figures if possible.

- Showcase some soft skills, especially around client management or presenting.

2 Banking Resume Summary Examples

Let's begin with what to avoid:

A summary like this does not include enough eye catching information.

Anything that isn't detailed information like names, numbers, and specifics is fluff.

Now let’s look at a better example:

At a glance, this entry-level summary delivers valuable information.

- It’s specific about the college name, degree and GPA.

- Includes information about internships, with real data.

- It shows the candidate has leadership skills, as the president of a university club.

Banker Resume Experience Section: Top Tips for Success

The experience section is the one that recruiters care most about.

Pay special attention to making this section of yourresume stand out to improve your chances of landing an interview.

This is your spot to describe all of your responsibilities and achievements from previous roles.

The best way to make an impact is to personalize your resume for the job you’re applying to.

While most banking jobs are similar, some will have extra requirements that you’ll want to address in your resume. Make a copy of your original resume and update your experience and skills sections to reflect what the employer is looking for.

For example, do they want someone who knows the mergers and acquisitions process like the back of their hand? If that sounds like you, focus on your past experience and achievements in these areas when writing your experience descriptions.

If you’re applying for a senior role, the employer might be looking for a candidate with leadership experience. If you’ve managed a team in your previous role, talk about the details (how many people, their success rate, etc.)

That’s a sure-fire way to convince the recruiter that you’re the one for the role (just don’tlie – that will catch up with you).

Let’s see these tips in action – here’s a bad resume experience section that needs work, and one that’s ready to be submitted.

Banker Resume Experience Examples

This example is okay, but could be improved. It’s not very descriptive, and doesn’t showcase expertise in the banking industry.

Let’s try again.

Much better!

This description is more detailed, showcasing real figures and achievements. It is specific about the responsibilities of the role, and includes “buzzwords” that will instantly capture a recruiter’s attention.

It also touches on important soft skills, like relationship management, which is essential in banking.

Now that’s done, we can move onto theskills section.

Important Technical and Soft Skills for Banking Jobs

A recruiter’s ideal banker will have both technical and soft skills. They’ll be looking for evidence of this combination in your resume.

Technical skills are the practical knowledge of banking. Do you know how to run a valuation analysis? Can you research and analyze industry and market data? What about executing M&A transactions? Are you a master at creating presentations to deliver to clients or stakeholders?

These are all questions and “buzzwords” that recruiters will be scanning for in your resume.

Our biggest tip for you is tocheck the job description to see what technical skills they’re looking for in the ideal candidate, and use those same buzzwords in your resume.

Hint: Look at the “responsibilities” or “requirements” section in the job description.

On the other hand, soft skills are the personality traits that will help you excel in such a client-facing role.

Recruiters are looking for candidates who not only know the in’s and out’s of finances, but who can develop and maintain great client relationships, communicate information in an understandable way, and who have excellent analytical skills.

You’re also expected to be able to work well with a team.

How to list technical and soft skills on your banker resume

As far as how to show off those skills, give them their own dedicated section and list them in bullet point format.

Start with ones that are most relevant to the role (and that appear in the job description).

How To Present Your Education On a Banker Resume

This section is essential in a banking resume – most roles require a degree, so recruiters will be looking for mention of one.

Here’s what to include:

- List the name of your college, years attended, include your majorandyour GPA. (The most common majors are finance, math, accounting, economics and statistics)

- List some relevant coursework.

- Include extracurricular clubs and activities, school projects, volunteering or anything else related to finance and/or banking.

If you already have years of banking experience, you can afford to lose some information in youreducation sectionin favor of a more detailed experience section. Your resume should be concise and preferably one-page long, so show off what’s most important.

Do Banking Roles Require Certifications?

Some jobs might require additional certification. You can check the job description to find out which ones.

In many entry-level banking roles, the employer will set you up to get more training,certifications or licensing. This could include CFA exams, CA designation, a Mutual Funds accreditation, etc.

If you already have it, or are currently working on extra certifications, that’s a huge added bonus. Add an extra section on your resume dedicated to certifications, designations and licenses. List them in bullet point format, starting with the most relevant to the role.

CFA certification is most commonly mentioned on job descriptions as an asset for analysts.

Here’s a list of banking-related certifications that would be a great asset to your resume:

Top 7 Banking Certifications For Your Resume

- CFA (Chartered Financial Analysts)

- CFP (Certified Financial Planner)

- CAIA (Chartered Alternative Investment Analyst)

- Certified Management Accountant

- Financial Modelling Certification

- Bloomberg Market Concepts

- FINRA Series 7 &63

- CPA (Certified Public Accountant)

- FRM (Financial Risk Manager)

Key takeaways for a banker resume

- Personalize every resume for each application you send. Look at the job description before you start writing to see what they’re looking for in their ideal candidate, and use those same “buzzwords” in your resume.

- Showcase a balance of soft and technical skills, listing them in the order of importance (based on what’s listed in the job description)

- Be specific in yoursummary and experience section about your previous responsibilities and any accomplishments you achieved.

- Include separate sections for education and certifications.

- Triple check your resume for any grammar or spelling mistakes. Attention to detail is important!